Understanding Arizona Auto Insurance Laws: A Phoenix-Based Guide

Key Takeaways

- Arizona law mandates all drivers carry liability insurance to cover damages in accidents, with specific minimum coverage limits.

- Minimum liability coverage includes $15,000 for bodily injury per person and $10,000 for property damage, though higher amounts are advisable.

- Comprehensive and collision coverage options are available, offering protection against non-collision incidents and vehicle repairs after accidents.

- Uninsured and underinsured motorist coverage is essential for financial protection against drivers lacking sufficient insurance or being completely uninsured.

- Factors such as driving record, age, vehicle type, and location in Phoenix can significantly affect auto insurance premiums.

Overview of Arizona Auto Insurance Requirements

When you hit the road in Arizona, it’s crucial to understand the state’s auto insurance requirements to stay compliant and protected. Arizona mandates that all drivers carry liability insurance, which covers damages to others in the event of an accident.

Failing to meet these requirements can lead to significant auto insurance penalties, including fines and potential license suspension. Additionally, be aware of insurance policy exclusions, which can limit your coverage in certain situations.

For instance, driving without a valid license or engaging in illegal activities might void your insurance benefits. Knowing these essentials will help you navigate Arizona’s laws confidently, ensuring you’re not only following the rules but also safeguarding yourself financially against unforeseen incidents on the road.

Types of Auto Insurance Coverage in Arizona

Understanding the types of auto insurance coverage available in Arizona is essential for every driver, as it helps ensure you have the right protection for your needs.

In Arizona, you’ll come across various coverage options, including comprehensive coverage and collision coverage. Comprehensive coverage protects you against non-collision incidents, like theft, vandalism, and natural disasters. This means you’re covered even when something unexpected happens outside of driving.

On the other hand, collision coverage helps pay for repairs to your vehicle after an accident, regardless of fault. Both types of coverage can provide peace of mind on the road, making it crucial to assess your situation and choose the right mix for your protection.

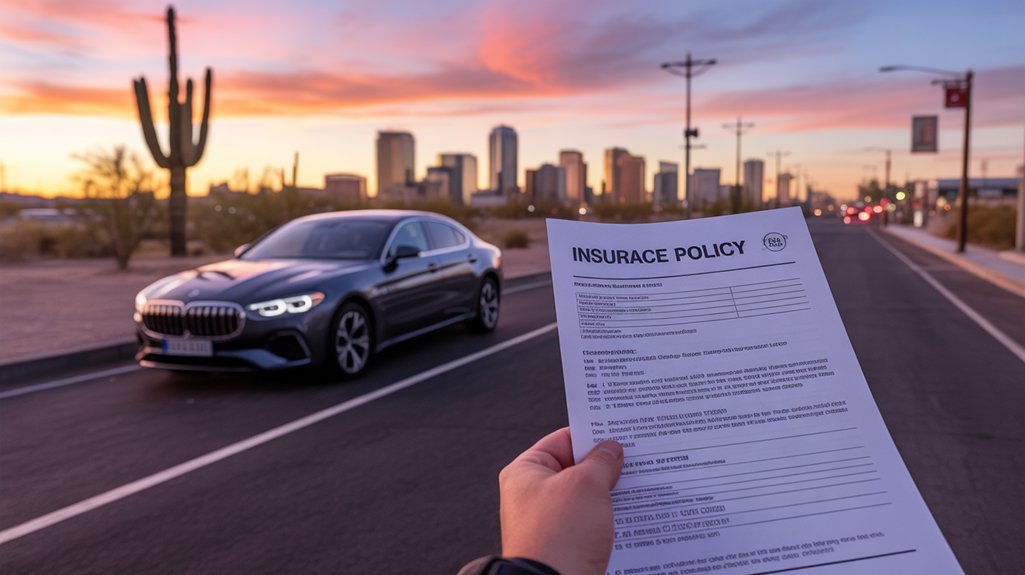

Minimum Liability Coverage Explained

Minimum liability coverage is a crucial aspect of auto insurance in Arizona, as it protects you from financial responsibility in the event of an accident. Arizona requires drivers to meet specific liability limits to ensure you’re covered. The minimum coverage includes bodily injury and property damage, essential for safeguarding your finances.

| Coverage Type | Minimum Liability Limits |

|---|---|

| Bodily Injury (per person) | $15,000 |

| Bodily Injury (per accident) | $30,000 |

| Property Damage | $10,000 |

Understanding these limits helps you make informed decisions about your policy. Always consider whether these minimums are sufficient for your needs, as higher coverage can provide added peace of mind on the road.

Understanding Uninsured and Underinsured Motorist Coverage

Many drivers overlook the importance of uninsured and underinsured motorist coverage, yet it can be a lifesaver in an accident. This coverage protects you when you’re involved with uninsured drivers or those whose insurance isn’t enough to cover your damages.

- Financial Security: It helps cover medical expenses and repairs when the at-fault driver lacks adequate insurance.

- Peace of Mind: You can drive knowing you’re protected against potential financial loss from uninsured drivers.

- Legal Expenses: It can cover legal fees if you need to pursue compensation.

- Increased Protection: Enhances your overall auto insurance policy, ensuring you’re better protected.

Don’t underestimate the value of this coverage; it’s essential for safeguarding your finances.

Factors Affecting Auto Insurance Premiums in Phoenix

When it comes to auto insurance, several factors can impact your premiums in Phoenix. Key premium determinants include your driving record, age, and the type of vehicle you drive.

If you’ve got a history of accidents or traffic violations, expect to pay more. Additionally, younger drivers often face higher rates due to their inexperience. Your car’s make and model also plays a significant role; high-performance vehicles typically carry steeper premiums.

Regional variations can affect costs too. For instance, urban areas may have higher rates due to increased theft and accidents compared to rural regions.

Understanding these factors helps you make informed decisions when shopping for auto insurance in Phoenix. For expert guidance, contact Phoenix Arizona Insurance.

Tips for Choosing the Right Auto Insurance Policy

- Policy Comparison: Look at various providers to compare rates and coverage options. Don’t settle for the first quote you receive.

- Coverage Options: Evaluate your needs—liability, collision, comprehensive, or uninsured motorist coverage. Choose what best protects you.

- Deductibles: Understand how different deductible amounts affect your premium and out-of-pocket expenses in case of a claim.

- Discounts: Inquire about available discounts, such as safe driver or multi-policy discounts, to lower your costs.

Frequently Asked Questions

What Are the Penalties for Driving Without Auto Insurance in Arizona?

If you drive without auto insurance in Arizona, you face serious penalties. An overview of uninsured consequences includes fines, license suspension, and potential vehicle impoundment, making it crucial to stay insured while on the road.

Does Arizona Allow Electronic Proof of Insurance While Driving?

Yes, Arizona allows electronic documentation as proof of insurance while driving. Just ensure your electronic proof meets the state’s proof regulations, so you’re not caught off guard if you need to show it.

Can I Switch Auto Insurance Providers Mid-Policy in Arizona?

Yes, you can switch auto insurance providers mid-policy in Arizona. Just check your current policy for cancellation terms, and consider a provider comparison to find better rates or coverage before making the switch.

How Does Arizona Handle Auto Insurance Claims Disputes?

In Arizona, if you face a claims dispute, you’ll navigate the claims process by gathering evidence and may use mediation or arbitration for dispute resolution. Always document everything to support your case effectively.

Are There Discounts Available for Safe Driving in Arizona?

Yes, you can find safe driving discounts in Arizona. Many insurers offer insurance premium reductions for maintaining a clean driving record. Check with your provider to see what specific discounts they provide for safe driving habits.

In conclusion, knowing Arizona auto insurance laws Phoenix is crucial for your protection on the road. By understanding the minimum coverage requirements and exploring additional options, you can make informed decisions that suit your needs. Keep in mind the factors that affect your premiums and don’t hesitate to shop around for the best policy. With the right coverage, you’ll drive through Phoenix with confidence, knowing you’re financially protected in any situation.

For trusted assistance, reach out to Phoenix Arizona Insurance or review safety insights at the NHTSA Road Safety Center.